The pandemic accelerated the growth of the industrial property segment even faster due to the disruption of the global supply chain in sectors such as electrical and electronics, health care, and e-commerce.

The transition of the "Just-in-Time" (JIT) Concept to "Store Ahead”, will it be the new norm?

Before the pandemic and trade war, many businesses adopted the just-in-time (JIT) concept to reduce the flow times and costs within production systems and material distribution. The main goal of JIT is to achieve lean inventories across the organisation and supply chain. Thus, for these businesses, the quicker they can sell their inventories, the faster they can get their cash back and improve their liquidity. There are many risks holding inventories for these businesses, including inventory waste, ageing stocks, increased warehouse cost, utility and management expenses, theft, and inventory misplaced.

Now, manufacturers are transitioning to the "store ahead" concept to avoid any possible disruptions in their business cycle. The boom of e-commerce and online business has accelerated the need for more space to process, package and store inventories. Another catalyst is the manufacturers can reach the consumers directly without going through retailers. Thus, they need more storage. However, as business normalises and production capacity is reverted, do manufacturers still need additional storage spaces?

Eventually, retailers will revert to an efficient holding stock level with technological advancements such as automation software and usage of automated storage and retrieval systems (ASRS.) Manufacturers now want to connect to consumers directly.

Booming of "build-to-suit" warehouses development

Expect Changes in Demand for Industrial Space

There are categories of growth in other business segments

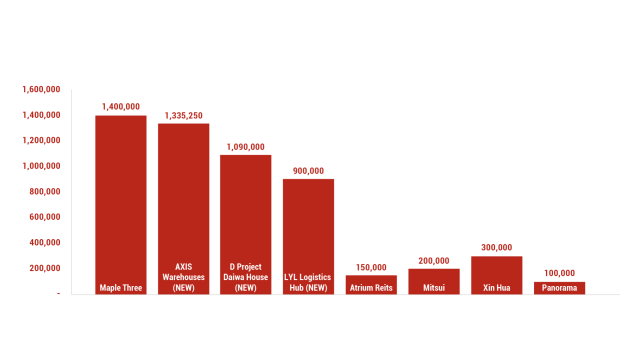

But 2022-2023 will see an additional 5.4Milsqft of space

Can the market absorb this amount of space?

Daiwa House Malaysia Logistics has developed a logistics facility project, D- Project Malaysia Phase 1 in Seksyen 33, on a land area of 326,700 sqft with 1 floor of a warehouse and 2 floors of offices. D-Project Malaysia Phase 1 is targeted to complete in June 2020.

Axis REIT has acquired a freehold land of 20 acres in Bukit Raja Selatan Industrial Park from FIW Steel Sdn Bhd to redevelop this plot of land into warehouses. The plan is to develop single-storey warehouse A, B, C, D, double-storey warehouse E and three-storey office.

LYL has successfully developed U10 Industrial Park Shah Alam Phase 1 on 60 acres of land with 9 warehouses and achieved 100% occupancy. LYL is launching its second phase covering a land area of 30 acres with 900,000sq.ft net lettable area.

Atrium Reit has considered purchasing a land parcel of 174, 757 sq ft in Seksyen 16 from Permodalan Nasional Berhad (PNB) with a single storey factory building, ancillary area, and a single-storey office-cum-canteen building. The rationale for purchasing is the strategic location in Seksyen 16 Shah Alam, a prime and mature industrial estate.

Mapletree has established Mapletree Logistics Hub in Seksyen 22 Shah Alam, with three blocks of three-storey ramp-up, multi-tenanted logistics and warehousing facilities. This industrial property has a build-up of 55,000 sq. ft.

Some manufacturers, such as Fraser & Neave Holdings Bhd (F&N), considered investing RM210 million in a new warehouse facility in Shah Alam to meet capacity expansion and business growth projections. Instead of relying on their third-party warehouses, they connect their consumers directly by renting a warehouse near Seksyen 26, Shah Alam and leveraging Tiong Nam logistics expertise.

Sime Darby Property and Asia Pacific logistics specialist LOGOS Property Group has established a fund management platform to invest and develop in "build-to-suit" to "lease or "sell" industrial and logistics assets. Besides, Sime Darby also partnered with Mitsui to develop land leases and BTS services for business owners. The build-to-suit concept means a commercial property tenant agrees with a developer to create a new custom-built facility for lease. Once the development is completed, the tenant will occupy the building and use it to operate. This kind of arrangement allows for optimally efficient use of both land and building for business needs.

LOGOS also entered a joint venture (JV) with local partner Global Vision Logistics Sdn Bhd to develop an RM1.5 billion sustainable integrated logistics, warehousing and e-commerce hub on three pieces of land. The land is roughly 71 acres in Section 16, Shah Alam, Selangor.

There is news that YTL and Shopee have partnered to develop a one three-storey mil sqft of warehouse space in Bukit Raja.

Many manufacturers and businesses are building their warehouse capabilities to cater to consumers' increasing and shifting demand.

Expect changes in demand for industrial space.

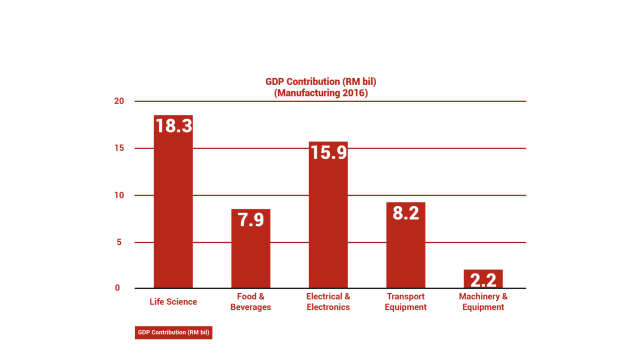

The shifting behaviour has benefitted food products, medical, engineering products and spare parts. Invest Selangor has developed five core economic clusters to focus on, including life science, food & beverages, electrical and electronics (E&E), transport equipment, machinery and equipment. We believe consumption will continue driving the growth of economics and shift the changes in demand for industrial spaces.

For the E&E side, the demand skyrockets during pandemics, especially the demand for laptops and personal computers due to work from home and the need for additional laptops for households to enable their children to study online. The land scarcity of Penang Island has motivated big tech players such as Greatech Technology Berhad to take up land elsewhere to expand their capacity. Korean semiconductor company Simmtech Company is also considering acquiring 18 acres of land for a capacity expansion plan.

Besides, the steel industry has also performed well lately due to the increase in prices. They are also expanding their capacity and looking for suitable spots for factories and warehouses to grow their businesses.

Data centres also benefited from the increase in transaction volume. In Johor, there is massive demand from SMEs in the data centres and logistics sector.

While looking from a life science perspective, more investment in research and development will increase the need for laboratories or research centres spaces.

How can we deal with increased warehouse spaces and new competitions, and changes in demand?

By 2022 and 203, we will witness an additional 5.2 mil sqft of spaces, But the big question is whether there is demand for these amounts of spaces? Our rationale is as the restriction for all lockdowns is slowly lifted, with the production resume and consumer consumption increases, will there be a need for high storage spaces?

How can IndustrialMalaysia help you navigate these challenges?

We think data analytics and marketing will be the game changers to solve these challenges. By understanding consumers of each business segment through the transaction data, we can help you identify the warehouse that fits your business needs and get the best deal in the most strategic location.